In a new report, Jon Peddie Research sheds some insight on the impact that cryptocurrency mining has had on AIB (add-in board) sales for the start of this year. Needless to say, AMD, Nvidia and their AIB partners have profited hugely from the high demand on the best graphics cards.

The consulting firm estimated that 25% of the graphics cards shipped in the first quarter of 2021 went into the waiting grubby hands of cryptocurrency miners and speculators. That's roughly 700,000 high-end and midrange gaming graphics cards. In monetary terms, we're looking at a hefty sum in the range of $500 million.

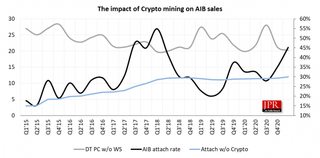

Jon Peddie Research, who has tracked AIB shipments since 1985, noticed a substantial drop in the attach rate of AIBs to PCs. The firm observed the attach rate stoop as low as 25% before eventually bouncing back up to 50%. Jon Peddie Research then utilized a simple formula where the mining use of AIBs is equivalent to the difference between the trending normal attach rate and the existing attach rate.

The company used the assumption that serious cryptocurrency miners have their dedicated setups and purchase graphics cards. On the flipside, there are also casual miners who might invest in a complete system just for mining cryptocurrency. The firm admitted that its forecast model isn't as precise as before due to the shortage of components. We've already witnessed scalpers and miners that employ buying bots to purchase graphics cards before flipping them on eBay.

Cryptocurrency miners aren't the only reason for the drastic inflation in graphics card pricing. The pandemic also played a big role in this situation since it forced many factories to temporarily shut down and interrupting supply chains in the process. It's been known that graphics card components, such as GDDR6 memory chips, voltage regulators, capacitors, and other parts, have also gone up in price since the start of the pandemic. Jon Peddie Research measured an increase of up to 70% early in the year.

AMD and Nvidia are basically untouched in our GPU benchmarks hierarchy, but the two companies are taking different stances toward cryptocurrency mining. For starters, AMD doesn't have any problems with consumers mining on its RDNA 2 (Big Navi) graphics cards. Nvidia, on the other hand, has launched its Cryptocurrency Mining Processor (CMP) line that's dedicated to Ethereum and cryptocurrency mining, and at the same time implemented an anti-mining limiter on most of its GeForce RTX 30-series (Ampere) graphics cards. The RTX 3060, RTX 3070 Ti, and RTX 3080 Ti all launched with a hashrate limiter in place, while the RTX 3060 Ti, RTX 3070, and RTX 3080 are being phased out and replaced by LHR (Lite Hash Rate) variants.

Despite both chipmaker's efforts — or non-efforts in AMD's case — graphics cards remain sold out everywhere. The little stock left retails for absurd prices, with Newegg often selling cards via its Shuffle program at 50% or more above the nominal MSRP. The second-hand market is even worse, as Ampere and Big Navi GPUs sell for 2X to 3.5X more than MSRP according to our GPU pricing index. Simply put, it's a bad time to buy a graphics card (for gaming).

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Zhiye Liu is a Freelance News Writer at Tom’s Hardware US. Although he loves everything that’s hardware, he has a soft spot for CPUs, GPUs, and RAM.

-

AtrociKitty ReplyThe company used the assumption that serious cryptocurrency miners have their dedicated setups and purchase graphics cards.

And also every enthusiast with a semi-modern CPU. -

spongiemaster Reply

Those would be accounted for based on historical data. As the article mentioned they were calculating based on the difference from baseline. There's no way to know how accurate their calculation is, but the numbers mentioned are their guesstimate.AtrociKitty said:And also every enthusiast with a semi-modern CPU. -

VforV I "love" the bias in this article:Reply

AMD doesn't have any problems with consumers mining on its RDNA 2 (Big Navi) graphics cards

Despite both chipmaker's efforts — or non-efforts in AMD's case

How it makes nvidia look good like the savior of gaming, when in fact is the opposite... pffft.

Why doesn't the author mention that RDNA 2 is was designed to be good at gaming and has native low mining performance (about half) vs Ampere which is a miners dream come true?

Why doesn't the author say that AMD made efforts from the design phase to not worry after, while nvidia is trying to appear to "care for gamers" and save face, thus making "efforts" now (LOL?) when in fact they are the ones that sold/sell GPUs directly to miners and gave miners drivers to unlock their own so called limited hashrate cards (3060)?

Why doesn't the author blame nvidia for the CMP cards, but instead makes them seen as a positive? When in fact they are mocking us gamers even more, because that silicon could have been used for more RTX cards, so that everyone has a chance (theoretically) to buy them? *(also more GPUs available = lower prices...)

This kind of "journalism" disgusts me... urinalists indeed. -

AtrociKitty Reply

Their report doesn't detail much, beyond admitting less precision due to current part shortages. I'd go a step further, and suggest four non-crypto factors that would make any historical model poor at best:spongiemaster said:Those would be accounted for based on historical data. As the article mentioned they were calculating based on the difference from baseline. There's no way to know how accurate their calculation is, but the numbers mentioned are their guesstimate.

New GPUs with large generational leap in performance

Part and supply chain weakness across the entire industry

Sudden pandemic demand spike for gaming computers

Influx of spendable cash from stimulus and large unemployment increases -

spongiemaster Reply

While those did happen, it's not clear what if any impact any of them had on the calculation JPR did or if JPR factored them into their calculations. I'm not sure #2 had any affect at all on the market share of cards sold to miners vs gamers.AtrociKitty said:Their report doesn't detail much, beyond admitting less precision due to current part shortages. I'd go a step further, and suggest four non-crypto factors that would make any historical model poor at best:

New GPUs with large generational leap in performance

Part and supply chain weakness across the entire industry

Sudden pandemic demand spike for gaming computers

Influx of spendable cash from stimulus and large unemployment increases -

AtrociKitty Reply

Direct from JPR:spongiemaster said:I'm not sure #2 had any affect at all on the market share of cards sold to miners vs gamers.

The model is not as precise today as it was in 2017 due to the overall shortage of parts.

-

JarredWaltonGPU Reply

Thankfully, your post is completely without bias, right? When you read the following, you immediately assumed we were praising Nvidia: "Nvidia, on the other hand, has launched its Cryptocurrency Mining Processor (CMP) line that's dedicated to Ethereum and cryptocurrency mining, and at the same time implemented an anti-mining limiter on most of its GeForce RTX 30-series (Ampere) graphics cards." We're not. We're stating facts. Nvidia did both of those things. AMD did exactly what we say it did (which is that it didn't attempt to limit mining performance).VforV said:I "love" the bias in this article:

How it makes nvidia look good like the savior of gaming, when in fact is the opposite... pffft.

Why doesn't the author mention that RDNA 2 is was designed to be good at gaming and has native low mining performance (about half) vs Ampere which is a miners dream come true?

Why doesn't the author say that AMD made efforts from the design phase to not worry after, while nvidia is trying to appear to "care for gamers" and save face, thus making "efforts" now (LOL?) when in fact they are the ones that sold/sell GPUs directly to miners and gave miners drivers to unlock their own so called limited hashrate cards (3060)?

Why doesn't the author blame nvidia for the CMP cards, but instead makes them seen as a positive? When in fact they are mocking us gamers even more, because that silicon could have been used for more RTX cards, so that everyone has a chance (theoretically) to buy them? *(also more GPUs available = lower prices...)

This kind of "journalism" disgusts me... urinalists indeed.

The whole basis of your anti-Nvidia complaints takes as an a priori assumption that Nvidia intentionally boosted mining performance for the Ampere launch, when we know that wasn't the case. In all the presentations Nvidia did at the Ampere launch, cryptocurrency wasn't mentioned once. Not. One. Single. Time. Do you know why? Because in August/September of 2020, no one was really looking at mining as a major concern, just like in the summer of 2017 people weren't really worried about mining. The exact same thing applies to AMD at RDNA2's launch: No one talked about mining performance as a reason for the Infinity Cache. In fact, I don't even think people were sure Infinity Cache wouldn't help mining! In the right set of circumstances, a 128MB L3 cache could have been a major boost (not necessarily for Ethereum, but certainly for other algorithms).

Why did AMD do the Infinity Cache? Because it was, relatively speaking, easier than making more cores and more features in those cores. A big cache consumes relatively little energy, and with the right workloads can impart a big speedup. It was a reasonably clever way to close the performance gap between RDNA1 and Ampere, without trying to match what AMD expected Nvidia to do with RT and DLSS. Was it elegant, though? I don't think so. I don't consider large caches an elegant solution in most cases, because there will always be workloads where the cache isn't large enough and thus doesn't provide as much of a benefit.

Anyway, Nvidia is absolutely profiteering off mining, and so is AMD -- just perhaps not as much as Nvidia. Nvidia is able to do things like CMP, LHR, etc. in part simply because they control 80% of the market. That's not good, or bad; it simply is what things look like. Nvidia did G-Sync because it could, same with RT and DLSS. AMD counters with alternatives that, of necessity, have to work with all GPUs rather than being limited to AMD hardware. If AMD controlled 80% of the GPU market, you can rest assured it would start behaving more like Nvidia -- we even have evidence of this, as AMD bumped up prices as soon as it started to get closer to Nvidia's performance and features.

For the record:

CMP: We don't like it, as best-case it's a GPU that could have gone into a non-CMP piece of hardware. Right now, even older Turing GPUs would be better than no GPUs for a lot of PC gamers. So far, CMP is exclusively (I believe) Turing and Volta GPUs, but CMP will likely have Ampere GPUs at some point that don't implement LHR. Nvidia is trying to have its cake and eat it too.

LHR: It's reactionary, only targets one algorithm (Ethash/Dagger-Hashimoto), and is only useful until/unless it gets cracked. Nvidia 'accidentally' (we don't know if it was truly an accident or not) gave away the keys to full hashrate 3060 with the old driver. So far, 3080 Ti, 3070 Ti, and all the revamped existing RTX 30-series GPUs with LHR implemented haven't be broken. That doesn't mean they'll never be broken.

Last: I don't believe for an instant that Nvidia's reported crypto sales are remotely close to reality. I think Nvidia counts CMP sales as crypto, and then everything else "must have gone to gamers" (wink wink, nudge nudge). Neither do I believe AMD isn't trying to make money from miners. In early 2019, AMD had great GPU profits, but in its earnings stated it expected profits to drop "due to falling demand from cryptocurrency miners." Both AMD and Nvidia are almost certainly dealing directly with large-scale miners. So are all their AIB partners.This story, meanwhile, was from a reputable source (JPR) suggesting at least one quarter of all GPUs sold in Q1'21 went to miners -- and of course Nvidia made proportionately a lot more from miners than AMD, since it sold far more discrete GPUs. You can try to put bias into all of this if you want, but that's more likely to use your own bias rather than facts. -

spongiemaster Reply

The rest of that paragraph explaining what they're talking about doesn't really clear it up for me. They're talking about the parts shortage bringing scalpers into the current market, which isn't entirely true and I still don't see how that has any impact on who is buying the cards. During the last mining bubble in 2017, there was no industry wide parts shortage, it was mining demand on its own. The end result was still demand outstripping supply, which brought scalpers into the market then. It doesn't matter that there's a parts shortage now, mining demand on its own still would have exceeded supply and brought scalpers into the market. And since mining demand is practically infinite, any other bottleneck in the system won't have any affect on price, unless it somehow pushes prices above what miners would be willing to pay based on projected mining returns.AtrociKitty said:Direct from JPR:

Most Popular